Selecting the right location for ecommerce

- Home

- >

- Cargo Blog

- >

- Selecting the right location for ecommerce

By Lori Musser

Story first appeared in the 2021 JAXPORT Magazine

In the early 1990s the internet was opened to commercial business, the century-old Sears catalog for general merchandise was retired, and people had a new way to order goods without having to set foot in a retail store.

Fast-forward to today and the adoption of ecommerce has skyrocketed as a result of the COVID-19 global pandemic – disrupting not only the way consumers consume but also retailer’s fulfillment strategies.

Traditional distribution models are being replaced by smaller fulfillment centers closer to major population centers. Site selection – now more than ever – is key as retailers look to position their business for growth in today’s market.

“It’s important that executives and teams leading a site selection process understand that few corporate decisions have as many immediate and long-term implications on tax structure, cost of goods sold, supply chain, labor force, culture and overall operating success as the choice of location,” according to Steven Bandolik, Managing Director with Deloitte Services LP and a senior leader in Deloitte’s real estate and construction services practice, in a recent Commercial Property Executive column.

SITE SELECTOR’S WISH LISTS

Isolde Decker-Lucke, Marketing Manager at location intelligence firm Skyhook, said in her October blog entitled Site Selection for Warehouses and Distribution Centers, “Location analytics can help these logistics businesses make informed decisions based on local customer base, access to resources, and transportation access.” According to Lucke, a thorough analysis will take into consideration current route performance, customer locations, access to raw materials, truck route efficiency, competitor locations, and government regulations including driver-hour limitation and energy restrictions.

Aundra Wallace

President, JAXUSA Partnership

Aundra Wallace is President of JAXUSA Partnership, Northeast Florida’s economic development agency. JAXUSA works with businesses throughout the site selection process – offering area expertise and insights. Wallace says when it comes to ecommerce businesses JAXUSA addresses the logistics “pain points”: reducing damage and loss of goods in transit, meeting consumers’ expectation for speedy delivery, and reducing the cost of last-mile delivery. JAXUSA also focuses on the region’s ability to meet labor requirements, and helps evaluate warehouse space availability.

Jeanette Goldsmith is Vice President of Strategic Development Group and a member of the Site Selectors Guild. She said, “I think companies often feel site selection is a simple real estate decision but done right it is a complex array of factors and how those factors interact with each other.”

She categorizes facilities into one of two categories to better understand their needs: labor-intensive (i.e. ecommerce, picking and packing) and capital-intensive (i.e. highly automated manufacturing). “Site selection for labor-intensive facilities is driven by workforce,” said Goldsmith. “Capital-intensive facilities are more driven by logistics, so regions with best access to raw materials and customers compete well. These types of facilities are also focused on lowest delivered cost for their outbound products.”

Northeast Florida checks off the boxes on ecommerce wish lists – with a résumé of ecommerce brands to solidify its claims.

Wallace said, “Over the last five years, JAXUSA has been involved in the announcement of 13 ecommerce operations which have invested more than $3.3 billion in infrastructure and generated more than 18,000 initial jobs, and in many cases have expanded since.”

The new logistics, distribution and fulfillment centers include the likes of Amazon and Wayfair, and furniture brands Industry West and Article, and more are coming, added Wallace. Many use JAXPORT for global sourcing and shipping, including aftermarket auto parts etailer 1A Auto. The company announced in December 2020 its plans to open an 86,800-square-foot Southeast distribution center near the port’s Blount Island Marine Terminal.

[clickToTweet tweet=”The proximity to the port, rail service, the airport and the city’s UPS Sort Center makes Jacksonville an excellent logistics location for retail and ecommerce. -1A Auto” quote=”The proximity to the port, rail service, the airport and the city’s UPS Sort Center makes Jacksonville an excellent logistics location for retail and ecommerce. -1A Auto”]1A Auto will use the facility to same-day ship imported auto accessories and repair parts from Asia for distribution throughout the Southeast U.S. 1A Auto’s Head of Logistics, Rich Higgins, told JAXPORT that the facility’s proximity to the port, rail service, the airport and the UPS Sort Center “makes Jacksonville an excellent logistics location for retail and ecommerce in particular … We’re able to reach virtually 100 percent of our customers in Florida overnight from Jacksonville, which was a real selling point for us.”

NORTHEAST FLORIDA’S APPEAL TO ECOMMERCE

Newcomers to the Jacksonville region have called the area a good place to “scale” up to serve the growing Florida population.

Wallace said access to market is a top selling point: “Companies can get to 98 million people within an 8-hour drive and our interstate access, robust rail system and exceptional port make our city very attractive.” That reach covers all of Florida and the Southeast U.S., which is the nation’s fastest-growing consumer market. Half the U.S. population can be reached with second-day delivery.

The tax climate is also a plus. “Florida is ranked fourth for best business tax climate by the Tax Foundation. Once you get to Florida, there is no corporate franchise tax, no state personal income tax, no inventory tax, low state sales and use rates, low corporate income tax, and the average property tax [in Northeast Florida] is relatively low compared to the rest of state,” said Wallace.

The availability and suitability of industrial warehousing space is a critical site selection factor. Robert Peek is Director and General Manager of Business Development for JAXPORT. Peek said the area has more than 144 million square feet of flexible warehousing space ready to handle a variety of cargo types.

That supply is important.

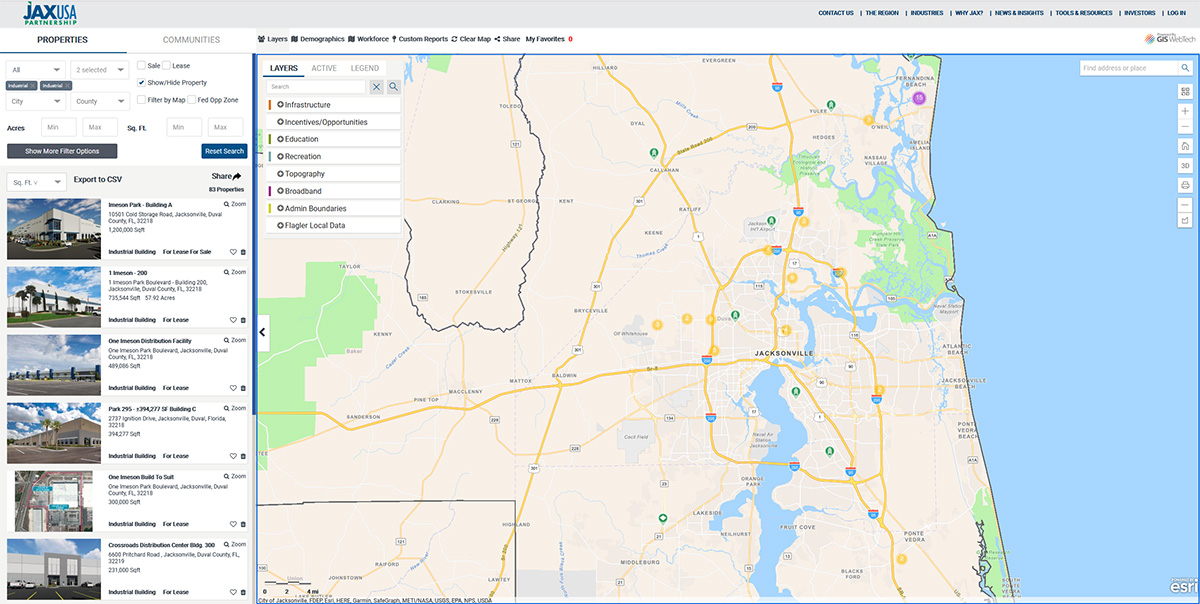

“Ecommerce companies want to start operations quickly. Having access to available buildings and sites is of utmost importance in the early stages of decision making,” said Wallace. “We’ve launched a new GIS web tool that provides business owners, brokers, site selectors and others information on commercial and industrial sites directly.”

The database provides maps of available workforce and demographic data, and helps provide incentive information for interested parties. “We want to make it easy to choose Jacksonville,” added Wallace.

A new CBRE report said that supply chain restructuring in response to COVID-19 may lead to new practices that drive demand for an additional 400 to 500 million square feet of industrial distribution space in the U.S. The report states that supply chains disrupted by the pandemic will end up restructuring, and increasing inventories closer to consumer and manufacturing locations.

The Northeast’s population, like Florida’s, is on the rise. “Jacksonville made the biggest gains of any city in the U.S. from April to August 2020 – 10.7 percent more people came than left,” said Wallace. “People are choosing Jacksonville, leaving high cost/high density cities and regions, for our quality of life, low cost of living, and great education system. With the growth, comes more consumers and an increased pool of skilled talent.”

Jacksonville’s workforce is young with an average age of 38, but Wallace said regional leadership is already collaborating on education and career academies to ensure the workforce of tomorrow is able to offer all the appropriate skills.

The greater Jacksonville area boasts 845,000 workers, said Wallace. By comparison, other Southeastern port cities in the U.S., like Charleston and Savannah, have under 150,000 in their talent pools.

Goldsmith pointed out some of Jacksonville’s best assets for attracting ecommerce: the port, existing industry clusters (including financial, insurance and healthcare firms, and manufacturing, particularly in aerospace), and the sizable workforce which is partly comprised of ex-military with ready-made tech skills. “These people are young and have time for a whole new career,” and their skills and work ethic really strengthen the area workforce, said Goldsmith.

Roughly 3,000 of the people who separate from the military each year stay in the region, according to Wallace.

Giant eRetailer Wayfair emphasized the importance of the workforce when its new facility at Cecil Commerce Center was announced. Wayfair’s James Savarese, Chief Operating Officer, said in the initial announcement, “With the opening of our new distribution center in Jacksonville, we know we will benefit from a strong talent pool and we look forward to contributing to the growth of job opportunities in the region as we welcome hundreds of employees to our world-class team.”

As Goldsmith noted – Jacksonville’s port also plays an important role in attracting retailers to the region.

Most ecommerce businesses require global connectivity to source their product. JAXPORT offers retailers access to more than 140 ports in 70 countries across the globe – supporting a diverse sourcing strategy which proved to be key when trade wars and COVID-19 shut down access to some markets. The port’s ocean connectivity is supported by outstanding intermodal options with options via both truck and/or rail.

Businesses set up shop in regions that offer unique and attractive assets. They choose a site only when it is good for business. The Jacksonville region has proven assets that are helping retailers not only survive the shift in their distribution model but also thrive.

From startups to large retailers, more and more businesses are choosing JAXPORT to optimize their ecommerce supply chains.

In this 18-page e-book from JAXPORT, learn how Northeast Florida is meeting the industry’s growing demand for industrial real estate space in close proximity to urban population centers.